Introduction: Many Americans find themselves unprepared for retirement, prioritizing luxury purchases over properly funding their retirement accounts. Let’s delve deeper into this issue and explore strategies to ensure a comfortable retirement.

1.The Rule of 80%: Financial advisors often advocate the “80 percent rule” for retirement income. This rule suggests that retirees will need around 80 percent of their pre-retirement income to maintain their lifestyle. Factors such as retirement savings, Social Security, and other income sources should be considered when calculating retirement needs.

2.Reducing Retirement Income Requirements

a. Pay Off Debt: Paying off debts, including mortgages and credit cards, before retirement can significantly reduce annual withdrawals needed during retirement. Eliminating a mortgage payment, for example, could save retirees thousands of dollars each year.

b. Savings Habits: Reviewing current savings habits can also impact retirement needs. Increasing contributions to retirement accounts, such as Roth IRAs or 401(k)s, can lower the amount needed in retirement. Additionally, living below one’s means and saving diligently can accelerate retirement savings.

c. Delay Retirement: Delaying retirement by a few years can have a substantial impact on retirement savings. Not only does delaying retirement allow for additional savings, but it also increases Social Security benefits and reduces the number of years in retirement that need to be funded.

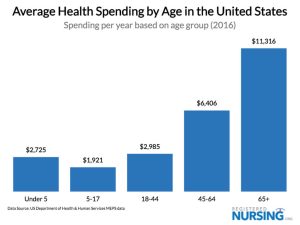

3.Healthcare Costs: Healthcare expenses are a significant consideration in retirement planning. It’s essential to anticipate rising healthcare costs and plan accordingly. Consulting with a financial advisor can help individuals estimate healthcare expenses and adjust retirement plans accordingly.

Conclusion: Starting retirement planning early and implementing effective strategies can ensure that retirement savings last a lifetime. Consulting with a financial advisor and carefully considering factors such as debt, savings habits, and healthcare costs can help individuals determine the ideal retirement date and maximize their retirement savings.