Mastering the stock market and deciphering its ever-changing trends can seem like an insurmountable challenge, but with the right methods, it becomes an art form that can potentially yield substantial financial gains. In today’s volatile global economy, understanding the key elements that drive stock market fluctuations has become an essential skill for investors seeking to navigate the tumultuous waters of financial markets. Whether you are an aspiring investor or a seasoned trader aiming to enhance your portfolio, this article will uncover the fundamental methods that will enable you to effectively analyze and decipher stock market trends. By delving into these techniques, you will gain the knowledge and confidence needed to make informed decisions, seize lucrative opportunities, and ultimately master the complex world of financial markets.

Understanding Stock Market Patterns: A Crucial Skill to Navigate Financial Markets

The stock market can often be a perplexing and volatile place, where understanding various patterns becomes a crucial skill for any investor. By recognizing these patterns, one can gain valuable insights into the market’s behavior, predict possible trends, and make informed decisions.

One of the most influential patterns is the bullish trend, characterized by a consistent rise in stock prices over a sustained period. Spotting this pattern can be advantageous for investors as it indicates a positive market sentiment and can lead to potential opportunities for profit. On the other hand, the bearish trend, characterized by a prolonged decline in stock prices, provides clues for potential downturns. Identifying these trends can help investors protect their assets or even benefit from short-selling strategies.

Here are some key reasons why understanding stock market patterns is so crucial:

- Timing entries: Recognizing patterns allows investors to time their entry into the market strategically. By buying stocks during bullish periods, investors can increase their chances of capitalizing on potential gains.

- Minimizing risks: Identifying patterns can help investors minimize risks by avoiding stocks or specific sectors experiencing prolonged bearish trends. This knowledge empowers them to reallocate their investments and safeguard their portfolios.

- Informing trading strategies: Knowledge of stock market patterns helps investors design effective trading strategies. By observing repeating patterns, investors can develop buy-low-sell-high strategies, capitalize on market fluctuations, and enhance their overall returns.

Mastering the art of understanding stock market patterns requires continuous learning, observation, and analysis. It is a skill that can give investors an edge, making their financial journey less daunting and more rewarding.

Analyzing Technical Indicators: Uncover Profitable Trading Opportunities

Analyzing Technical Indicators for Uncovering Profitable Trading Opportunities

When it comes to successful trading, analyzing technical indicators can make all the difference in identifying profitable opportunities. These indicators are powerful tools that assist traders in understanding market trends, price movements, and potential entry and exit points. By studying these indicators, traders gain valuable insights into the behavior of various financial instruments, allowing them to make informed decisions and increase their chances of success.

One of the key advantages of analyzing technical indicators is their ability to provide objective and quantifiable information. These indicators are based on mathematical calculations and historical data, eliminating any emotional biases or subjective interpretations. By utilizing these tools, traders can effectively filter out the noise of the market and focus on reliable data points. Whether it’s moving averages, relative strength index (RSI), or stochastic oscillators, technical indicators offer a wide array of insights that help traders navigate the complexities of the financial markets.

- Identify trends: Technical indicators enable traders to identify different types of trends, such as uptrends, downtrends, or sideways movements. This information helps traders align their strategies with the prevailing market conditions.

- Spot potential reversals: By analyzing indicators like the RSI or MACD, traders can identify potential trend reversals and take advantage of favorable entry and exit points.

- Confirm or challenge assumptions: Technical indicators provide traders with data that either confirms or challenges their assumptions about market behavior. This helps traders make adjustments to their strategies based on tangible evidence.

Ultimately, analyzing technical indicators empowers traders with critical information needed for making profitable trading decisions. By incorporating these tools into your trading routine and staying vigilant, you can uncover hidden opportunities that may have otherwise gone unnoticed. Remember, successful trading is a continuous learning process, and utilizing technical indicators will undoubtedly enhance your decision-making abilities.

Fundamental Analysis: Key Factors to Evaluate a Company’s Worth

When it comes to evaluating the worth of a company, a thorough fundamental analysis is essential. By analyzing a company’s key factors, you can gain valuable insights that will help you make informed investment decisions. Let’s explore some of the critical elements to consider:

- Financial Statements: Start by scrutinizing the company’s financial statements, including the balance sheet, income statement, and cash flow statement. These documents provide a comprehensive overview of the company’s financial health, revealing crucial information about its revenue, expenses, assets, and liabilities.

- Market Position: Consider the company’s competitive advantage and market position. Evaluate its market share, unique selling propositions, and ability to stay ahead of industry trends. A strong market position indicates stability and growth potential.

- Management Team: Assess the expertise and track record of the company’s management team. Look for experienced leaders with a clear strategic vision and a history of successful decision-making. A competent management team is crucial for long-term success.

- Industry Analysis: Analyze the industry in which the company operates. Understand its growth potential, competition, and any upcoming regulatory changes that may impact the company’s prospects. A promising industry with favorable trends is a positive sign for the company’s future.

By thoroughly evaluating these key factors and conducting in-depth research, you can make well-informed investment decisions. Remember, a strong fundamental analysis forms the foundation for successful investing. Take the time to dig deeper and discover the true worth of a company before making any financial commitments.

Mastering Risk Management Strategies: Safeguard Your Investments

In today’s unpredictable financial landscape, it is vital for investors to have a solid understanding of risk management strategies. By mastering these strategies, you can effectively safeguard your investments and navigate the complexities of the market with confidence. Here, we will explore some key tips and techniques to help you mitigate risk and ensure the longevity of your portfolio.

Diversify Your Portfolio: One of the most effective risk management strategies is to diversify your investments. By spreading your funds across a variety of asset classes, industries, and geographic regions, you can minimize the impact of any single investment’s performance on your overall portfolio. This can be done through investment vehicles such as mutual funds, exchange-traded funds (ETFs), and index funds.

Set Realistic Goals: Another crucial aspect of risk management is setting realistic financial goals. Understanding your own risk tolerance and investment objectives will help you make informed decisions and resist the temptation to chase high-risk, high-reward opportunities. By having a clear vision of what you want to achieve and establishing a solid plan, you can minimize the likelihood of making impulsive and potentially detrimental investment choices.

To Wrap It Up

In conclusion, deciphering stock market trends is an essential skill that every investor should strive to master in order to navigate the dynamic and ever-evolving financial markets. By arming yourself with the key methods we have discussed throughout this article, you can position yourself to make more informed decisions, minimize risks, and maximize your financial growth.

Understanding the intricacies of stock market trends provides you with a solid foundation to assess the market’s behavior and underlying factors that drive stock prices. Whether you are a seasoned investor or a novice looking to dip your toes into the market, employing these methods will undoubtedly enhance your ability to spot opportunities and make calculated investment choices.

Moreover, by studying historical trends, tracking fundamental analysis indicators, and staying abreast of market news and sentiment, you can better anticipate market movements and position yourself strategically. This empowers you to act decisively, optimizing your portfolio’s performance and ensuring long-term success.

While navigating the stock market may seem daunting at times, this article has provided you with a roadmap to master financial markets. It is crucial to approach this endeavor with a neutral mindset, conducting thorough research and analysis, while also exercising caution and sound judgment.

Remember, mastery of stock market trends is a continuous journey. It demands persistence, adaptability, and honing your skills over time. Embrace the learning process, seek guidance from experts when needed, and always be open to expanding your knowledge base.

By thoroughly studying the market, equipping yourself with the necessary tools, and building a network of like-minded individuals, you are taking an important step towards becoming a proficient investor in the financial markets. So, embrace the challenge and embark on this exciting journey towards unlocking the vast potential that lies within the stock market landscape.

In the end, the rewards are substantial, and with the right approach, you can not only decipher stock market trends but also seize opportunities that lead to remarkable financial success. Happy investing!

The stock market can seem intimidating and overwhelming for those unfamiliar with its eccentricities and nuances. It can be difficult to ascertain the best way to approach investing, particularly when it comes to interpreting stock market trends. There is no one-size-fits-all approach, but there are some methods that can help investors identify and react to changes in the stock market.

Financial research and analysis is the most important step for any stock market investor. Keeping on top of market reports and news is essential in order to identify emerging trends. Adopting a portfolio strategy allows investors to spread their assets across multiple markets and reduce risk. A combination of fundamental and technical analysis is also important in determining the likely direction of a stock’s price in the near future.

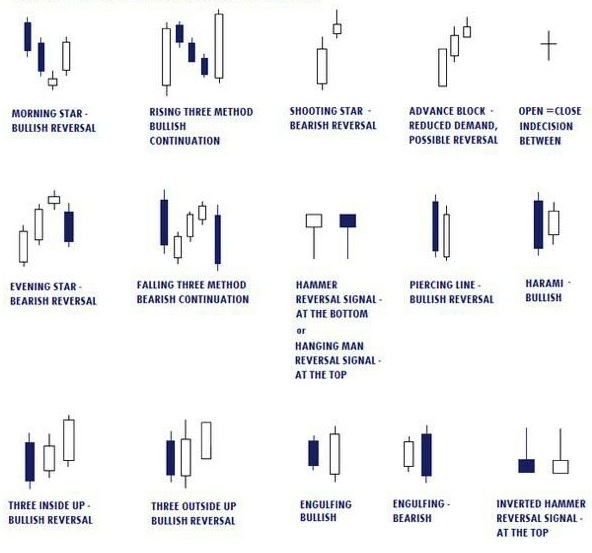

Investors should pay attention to the news to identify sector trends and understand the financial landscape. Monitoring fluctuations in day-to-day pricing as well as taking note of insider transactions provides greater insight into market performance. Charting is also a useful tool for interpreting patterns in the movement of stock prices.

Finally, keeping a close eye on the financial industry changes allows investors to stay informed of the latest developments. Utilizing a financial market simulator or other online resources can allow greater flexibility and experiment with investments without risking financial losses. Keeping close tabs on the impact of news on the market is the key to making informed investment decisions.

Deciphering stock market trends is a complex endeavour, but with careful consideration and diligent research, the investor can gain a better understanding of how to navigate the complexities of the markets and, in turn, make more successful investments.