Throughout history, there have been many transformative events that have shaped the trajectory of nations, economies, and societies. One such event that left an indelible mark on the global economy was the Wall Street Crash of 1929. Often hailed as the catalyst behind the Great Depression, this catastrophic market collapse sent shockwaves reverberating worldwide, leaving devastating consequences in its wake. As we delve into the depths of this fateful event, we uncover invaluable lessons that serve as a stark reminder of the fragile nature of economies and the dire consequences of unchecked speculation. Join us on this journey as we meticulously examine the factors that led to the crash, the profound impact it had on the world, and the valuable lessons that we must grasp to prevent history from repeating itself.

The Devastating Impact on the Economy: Analyzing the Market Shocks of the Wall Street Crash

As one of the most significant events in economic history, the Wall Street Crash of 1929 sent shockwaves throughout the world, leaving a trail of destruction in its wake. The aftermath of this catastrophic event had a profound impact on the global economy, upending lives, businesses, and governments alike. By delving into the market shocks that ensued, we can gain valuable insights into the far-reaching consequences of this historic crash.

One of the immediate effects of the Wall Street Crash was the collapse of stock prices. As investors rapidly sold off their shares, the stock market plunged into a downward spiral. This sharp decline in asset values led to a loss of confidence among both investors and consumers. As a result, businesses saw a significant decrease in demand, leading to a wave of bankruptcies and job losses. The crash also exposed the weaknesses in the banking system, triggering a series of bank failures that further exacerbated the economic turmoil.

- Unemployment: The crash sparked an unprecedented rise in unemployment rates as companies were forced to downsize or shut down completely. Joblessness became widespread, leaving countless families struggling to make ends meet.

- Investor Losses: The crash wiped out billions of dollars in investments, impacting not only individual investors but also financial institutions and pension funds.

- International Trade: The global economy was severely affected by the crash, as it caused a sharp decline in international trade. Countries heavily reliant on exports experienced a decline in demand, leading to a prolonged period of economic stagnation.

Overall, the Wall Street Crash of 1929 had a devastating impact on the economy, setting the stage for the Great Depression that followed. By analyzing the market shocks that emerged from this event, we can gain vital insights into the fragilities of the financial system and the importance of implementing regulations to prevent future crises.

Unveiling the Root Causes of the Great Depression: Key Lessons from the Wall Street Crash

Delving into the depths of history, one event stands as a cataclysmic turning point – the infamous Wall Street Crash, shaking the very foundations of the global economy and giving birth to the Great Depression. As we peer through the fog of time, it is essential to unravel the complex web of factors that contributed to this dark chapter. By understanding the root causes, we can equip ourselves with invaluable knowledge to navigate our present and build a more resilient future.

1. Over-speculation and Excessive Borrowing: The roaring 1920s witnessed a frenzied rush into the stock market, fueled by irrational exuberance and a dangerous cocktail of greed and speculation. Investors borrowed heavily to invest in stocks with the hopes of quick and massive returns. This speculative bubble grew to unsustainable levels, creating an illusion of prosperity that turned out to be a house of cards.

2. Inadequate Government Intervention: The laissez-faire approach adopted by governments during the 1920s aggravated the economic imbalances that fueled the crash. Regulatory oversight was lax, allowing unchecked speculation and dubious business activities to flourish. Moreover, monetary policies failed to address the underlying issues, exacerbating the consequences when the inevitable crash occurred. These past mistakes teach us the importance of effective government intervention in maintaining stability and preventing crises.

Mitigating Future Financial Crises: Essential Recommendations from the Wall Street Crash

The Wall Street Crash of 1929 brought the world to its knees and demonstrated the urgent need for measures to prevent future financial catastrophes. Delving deep into the lessons learned from this pivotal event, we have identified essential recommendations that can help mitigate the impact of future crises. By implementing these measures, we can strive for a more stable and resilient global economy.

1. Strengthen Financial Regulations: The adoption of stricter financial regulations is paramount to guard against excessive risk-taking and ensure the well-being of the financial industry as a whole. By imposing limits on leverage ratios and capital requirements, we can ensure that financial institutions operate within a prudent framework, minimizing the potential for systemic collapse.

- Establish independent regulatory bodies tasked with monitoring and enforcing compliance across the financial sector.

- Implement comprehensive stress tests to assess the resilience of financial institutions in adverse scenarios.

- Create stricter regulations on the sale and trading of complex financial instruments to prevent the rapid dissemination of toxic assets.

2. Encourage Transparency and Accountability: In order to restore investor confidence and reduce market volatility, it is crucial to enhance transparency and accountability among all market participants. By fostering a culture of openness, we can help reinstate trust and promote responsible financial behavior.

- Enforce mandatory disclosure requirements for financial institutions, ensuring timely and accurate reporting of their financial health.

- Establish a centralized and accessible database for tracking systemic risks, providing regulators with real-time information to make informed decisions.

- Hold executives and key decision-makers accountable for their actions, imposing penalties and restrictions to discourage reckless behavior.

By heeding these recommendations derived from the Wall Street Crash, we can pave the way for a more stable and secure financial system. The prevention and mitigation of future financial crises require a comprehensive and coordinated effort from governments, regulators, and market participants. Let us remember the lessons of the past and take action now to secure a brighter and more resilient financial future.

Key Takeaways

In conclusion, the Wall Street Crash of 1929 stands as a stark reminder of the catastrophic consequences that can ensue when unchecked speculation and faulty economic policies collide. The shockwaves of this event reverberated throughout the world, plunging economies into deep recession and perpetuating the hardship endured by countless individuals for years to come.

However, it is crucial to approach this dark chapter of history with a neutral perspective, recognizing not only the failures but also the valuable lessons it teaches us. The Great Depression brought to light the urgent need for enhanced regulatory measures, monetary policy reforms, and more responsible financial practices. It serves as a cautionary tale, reminding us of the dangers of excessive risk-taking and the detrimental effects of an unregulated and unstable market.

Today, as we navigate a complex global economy, we have the opportunity to reflect on the past and apply the lessons learned from the Wall Street Crash. We must remain vigilant in monitoring our financial systems, ensuring transparency and accountability, and adhering to prudent regulations. By doing so, we can mitigate the risk of future economic crises and protect the livelihoods of individuals and families across the globe.

Moreover, the Wall Street Crash of 1929 underscores the importance of international cooperation in times of crisis. The global interconnectedness of economies demands collaboration and coordination. Governments, policymakers, and financial institutions must work together to implement effective, coordinated measures aimed at stabilizing markets and fostering economic recovery.

In scrutinizing the events that unfolded during the Great Depression, we gain a deeper understanding of the fragility of our economic systems and the immense power they hold over our lives. It is through this understanding that we are empowered to build a more resilient and inclusive economic framework, capable of withstanding future shocks. Let the lessons from the past guide us towards a future where prosperity and stability are accessible to all.

In conclusion, the Wall Street Crash of 1929 was a devastating chapter in history, but it need not be a recurring nightmare. By adopting a neutral perspective and heeding the lessons it provides, we can harness the collective wisdom of the past to shape a better tomorrow for all.

The Wall Street Crash of 1929 was one of the most devastating financial crashes in American history, leading to a decade of economic hardship and ultimately contributing to the Great Depression. To this day, the effects of the Wall Street Crash are felt in both the financial and political realms, with the crash exposing the potentially harmful effects of unregulated speculation. In this article, we will explore the causes and lasting consequences of the Wall Street Crash and discuss the lessons learned from this period.

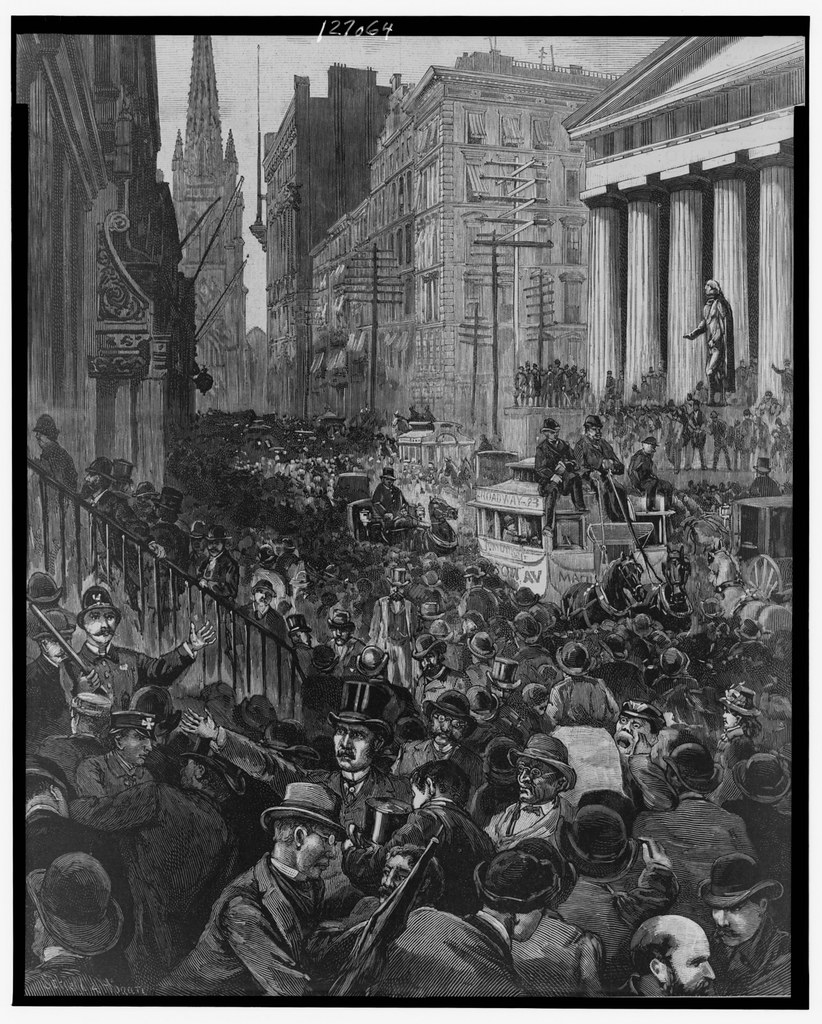

In late 1929, the stock market was booming and investors felt that the financial wins would last indefinitely. However, stock prices had become severely overvalued, supported only by the influx of speculators buying stocks in the hopes that prices would continue to rise. Leverage was common, with investors taking out margin loans to buy additional stocks. On October 24, 1929, the bubble burst when a wave of panic selling began, leading to a significant correction in stock prices. This marked the beginning of the Wall Street Crash of 1929.

The stock markets continued to decline for three consecutive years, leading to unprecedented losses in wealth and economic stress. Millions of investors saw their paper wealth evaporate overnight, leading to a deep economic recession. The depth of the Great Depression was made worse by laissez-faire economic policies and the failed Smoot-Hawley Tariff act.

The legacy of the Wall Street Crash continues to have a lasting impact on the financial and political spheres. Investors are now more aware of the risks of leveraged investments and of the importance of diversifying a portfolio to spread risk. Politically, governments have become more proactive in responding to market downturns, with the introduction of rules and regulations that protect consumers and limit the effects of speculation.

Overall, the Wall Street Crash of 1929 serves as a dramatic reminder of the need for market discipline and prudent regulation. While the lasting effects of the crash are still felt today, they have made investors, governments and regulators alike more aware of the dangers of speculation and leveraged investments. Most importantly, the lessons learned from this period are still relevant in today’s market.